Valuation for Mergers and Acquisitions

Have you ever wondered how companies determine the value of a potential merger or acquisition? Valuation plays a crucial role in the decision-making process regarding M&A deals. It involves assessing a business's or its assets' worth to ensure that the deal is financially sound.

Mergers and acquisitions are complex transactions that require careful planning and analysis. Valuation is a key component of this process, as it helps both parties involved in the deal to understand the true value of the target company. Companies can negotiate better terms and make informed decisions by determining the business's fair market value.

Valuation for mergers and acquisitions is vital to make or break a deal. It requires thoroughly evaluating various factors, such as financial statements, market trends, and industry dynamics. By understanding the valuation process, companies can ensure that they make sound investment decisions and maximise the deal's potential benefits.

Understanding the valuation for mergers and Acquisitions

Valuation in the context of mergers and acquisitions (M&A) refers to determining a target company's economic value. This valuation is crucial as it influences the negotiation process, the price paid, and the overall success of the transaction. The goal is to arrive at a fair value that reflects the target company's worth, considering its assets, liabilities, earnings potential, and market conditions.

Mergers

A merger involves the combination of two companies to form a new entity. Both companies dissolve their previous identities and create a new organisation with a new ownership and management structure. Mergers can be categorised as friendly or hostile, depending on the level of cooperation between the involved parties. Friendly mergers are those where both companies agree to the merger, while hostile mergers occur without the consent of the target company's management.

Acquisitions

An acquisition occurs when one company purchases another company outright. The acquired company ceases to exist as an independent entity and becomes part of the acquiring company. Acquisitions can be friendly or hostile, depending on whether the target company's management agrees. Acquisitions are often pursued to control the acquired company's assets, expand market share, or acquire new technologies.

Importance of Valuation for Mergers and Acquisition

Valuation plays a pivotal role in mergers and acquisitions (M&A) by providing a comprehensive understanding of the true worth of the entities involved. Here are key reasons why valuation is crucial in M&A:

Establishing a Fair Purchase Price

Fair Value Determination: Valuation ensures that the acquiring company pays a fair price for the target, reflecting its true market value.

Basis for Negotiation: It provides a solid foundation for negotiation between the buyer and the seller, facilitating a mutually agreeable transaction price.

Making Informed Investment Decisions

Risk Assessment: A thorough valuation helps identify potential risks and rewards, enabling better decision-making.

Strategic Alignment: It ensures the acquisition aligns with the strategic objectives of the acquiring company, evaluating whether the target’s business model complements the acquirer’s goals.

Financing and Funding Requirements

Capital Planning: Valuation determines the capital needed for the acquisition, influencing the financing structure (cash, debt, or equity).

Lender Confidence: Accurate valuation helps secure financing by demonstrating the deal’s viability to lenders and investors.

Regulatory and Compliance Requirements

Fairness Opinions: Regulators often require fairness opinions to ensure the deal is fair to all shareholders, particularly minority shareholders.

Tax Planning: Proper valuation aids in understanding the tax implications of the transaction, ensuring effective tax planning and compliance.

Integration and Synergy Realization

Identifying Value Drivers: Valuation highlights key value drivers that must be preserved and enhanced during integration.

Performance Measurement: It sets benchmarks for measuring the performance of the combined entity post-merger, facilitating effective performance management.

Enhancing Market Perception and Confidence

Investor Assurance: A well-substantiated valuation reassures investors and shareholders about the transaction’s value proposition.

Market Confidence: It positively influences market perception and can lead to favourable movements in stock prices for the acquiring company.

Synergy Evaluation

Cost and Revenue Synergies: Valuation helps quantify potential synergies, such as cost savings and additional revenue streams, justifying the acquisition.

Value Creation: It assesses whether the combined entity will create more value than the individual companies, validating the strategic rationale for the M&A.

Key Valuation Methods in M&A

1. Discounted Cash Flow (DCF) Analysis

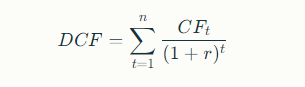

The DCF method estimates the value of a company based on its expected future cash flows, which are discounted back to their present value using a discount rate. This method is particularly useful for companies with predictable and stable cash flows.

The formula for DCF is:

2. Comparable Company Analysis (CCA)

This method involves comparing the target company to similar companies in the same industry that were recently sold or publicly traded. Key financial metrics such as the price-to-earnings (P/E) ratio, enterprise value-to-sales (EV/Sales), and others are used to estimate the target company's value.

3. Precedent Transactions

Precedent transaction analysis looks at the prices paid for similar companies in past M&A deals. This method helps establish a benchmark for the valuation by considering the multiples paid in comparable transactions.

4. Leveraged Buyout (LBO) Analysis

LBO analysis determines the maximum price a financial buyer can pay for a company while achieving a target return on investment. It involves projecting the company's cash flows and determining the debt capacity to finance the acquisition.

5. Asset-Based Valuation

This method calculates a company's value based on its assets' net value, subtracting liabilities from the total asset value. It is often used for companies with significant tangible assets, such as real estate or manufacturing firms.

6. Market Approach

The market approach values a company based on the market prices of similar businesses. This method is frequently used when comparable companies are in the same niche and geographic area.

7. Real Option Analysis

This method evaluates the value of tangible assets, such as machinery or property, which can add value to the deal. It is particularly useful for companies with significant physical assets.

8. Dividend Yield Method

This method values a company based on the present value of its future dividends. It is similar to the DCF method but focuses on dividends instead of cash flows.

Need for valuation of Mergers and Acquisitions.

During Mergers and Acquisitions, the purpose of the valuation for mergers and acquisitions is identified so that the calculated value matches the required purpose.

A few instances where the valuation is done based on the purpose are:

-

Corporate Restructuring

-

Calculating the consideration for the sale of business or acquisition

-

Liquidation of the company

-

Calculating the consideration for the sale or purchase of equity stake

-

During family separation, there is a need to calculate the value of assets and businesses owned by such a family

-

The portfolio value of investments is calculated by Private Equity Funds or Venture Funds

-

Purchase or sell intangible assets such as rights, patents, trademarks, copyrights, brands, etc.

-

The fair value of the shares is required to get listed on the Stock Exchange.

Why choose R.K Associates for Valuation for Mergers and Acquisitions?

Choosing R.K Associates for the valuation of mergers and acquisitions (M&A) offers several compelling advantages:

Extensive Experience and Expertise

R.K Associates is a registered valuer organisation with over 35 years of experience in valuations and consulting, making us a seasoned player in the industry. We have handled complex and large-scale projects across various sectors, including power, steel, cement, and real estate.

Comprehensive Service Offerings

Our firm provides a wide range of services related to M&A, including corporate valuation, transaction advisory, and process advisory services. Our expertise extends to detailed project reports, techno-economic feasibility studies, and lender's independent engineering services, which are crucial for informed decision-making in M&A transactions.

High Standards and Professional Ethics

R.K Associates prides itself on maintaining the highest professional ethics and integrity, making us the best Valuers in Noida and India. Reports are known for being comprehensive, detailed, and error-free, which is essential for the accuracy and reliability needed in M&A valuations.

Innovative and Technologically Advanced

Our firm has developed the world's first fully digital platform, 'Valuation Intelligent System,' to integrate the complete valuation life cycle. This platform helps maintain a rich valuation and mortgage property information database, significantly benefiting the banking and financial sectors.

Pan-India Presence and Diverse Industry Coverage

With offices across major economic centres in India and a team of over 75 engineering and finance experts, we have a strong presence and the capability to handle projects in more than 30 diverse industry types. This extensive network ensures that they can provide localised expertise and support for M&A activities across the country.

Recognition and Trust

R.K Associates is empanelled with major public sector banks and financial institutions, which speaks to their credibility and trustworthiness in the industry. Have also received numerous accolades and awards from reputed institutions and societies, further establishing their reputation as a leading valuation and consulting firm.

Choosing the right partner for the valuation of mergers and acquisitions is crucial for the success of your business transactions. With R.K Associates, the best property valuers in noida, you gain access to over 35 years of unparalleled expertise, a comprehensive suite of services, and a commitment to the highest standards of professionalism and integrity. Our innovative digital platform and extensive industry coverage ensure you receive accurate, reliable, and insightful valuations tailored to your needs.

Take the next step towards informed and successful M&A transactions. Contact R.K. Associates, which offers the best Valuation services in India today, to leverage their expertise and ensure the best outcomes for your business.

Call us at (0120) 4110117, 4324647, +91-9958632707) or email us at valuers@rkassociates.org to discuss your needs.

FAQ

What is M&A valuation?

M&A valuation is determining the worth of a company involved in a merger or acquisition, using various financial techniques to assess its fair market value.

What does M&A stand for?

M&A stands for Mergers and Acquisitions, which refers to consolidating companies or assets through various financial transactions.

What is the best valuation method for M&A?

There is no single best method, but commonly used approaches include Discounted Cash Flow (DCF) analysis, Comparable Company Analysis, and Precedent Transactions. The choice depends on the specific circumstances of the deal.

How do M&A create value?

M&A create value through synergies, such as cost reductions, increased revenue opportunities, improved market reach, enhanced technological capabilities, and better resource utilisation.

How do you evaluate a merger and acquisition?

Evaluate a merger and acquisition by analysing financial performance, assessing strategic fit, conducting thorough due diligence, understanding cultural compatibility, and considering regulatory and compliance issues.